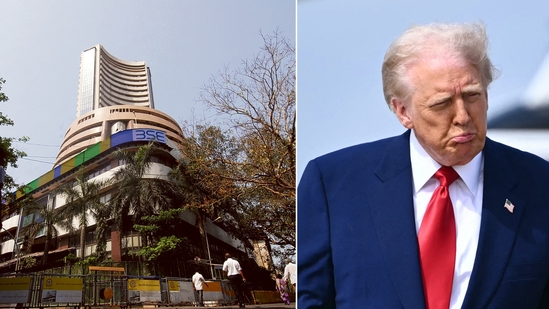

CNN Central News & Network–ITDC India Epress/ITDC News Bhopal: The Indian stock market witnessed a sharp downturn today, with both the Sensex and Nifty experiencing significant losses. This unexpected fall has raised concerns among investors, prompting a search for underlying reasons. Analysts attribute the decline to a combination of global cues, rising crude oil prices, geopolitical tensions, and foreign institutional investors (FIIs) pulling out funds. Additionally, recent inflation data and fears of potential interest rate hikes have further shaken market confidence.

Sectors like banking, IT, and real estate saw sharp corrections, while defensive sectors like FMCG and pharmaceuticals remained relatively stable. The volatility index (VIX) also spiked, indicating heightened fear in the market. Global uncertainties, especially surrounding the U.S. Federal Reserve’s monetary policy stance, are adding pressure on emerging markets like India.

Experts suggest that while this dip may be temporary, cautious investing is advised. They recommend focusing on fundamentally strong stocks and avoiding panic selling. Retail investors are also encouraged to consider long-term goals rather than short-term volatility.

Today’s market movement serves as a reminder of how interconnected global and domestic factors can significantly impact investor sentiment and market performance.

#Sensex #Nifty #IndianStockMarket #StockMarketCrash #MarketNews #FIIsSelling #InflationImpact #InterestRates #GlobalCues #InvestorSentiment